When contemplating your retirement plan, it’s useful to consider Social Safety not simply as a security internet, but additionally as an funding. How and whenever you declare your advantages can have a profound impact in your monetary outcomes in retirement. On this article, we’ll dive into completely different approaches to claiming Social Safety, and see how they evaluate when considering of your advantages as a part of your general retirement funding technique.

Early vs. Delayed Social Safety Advantages

One of many key choices you’ll make in retirement is when to start claiming your Social Security benefits. You possibly can start as early as age 62, or delay till age 70, with every possibility resulting in completely different monetary outcomes. Selecting when to say impacts each the annual profit quantity and the strain positioned in your funding portfolio.

Let’s have a look at a hypothetical instance the place you wish to spend $60,000 per yr in retirement, and a funding portfolio of $800,000. The quantity of Social Safety advantages you obtain will depend upon whenever you declare them, and your portfolio might want to cowl something that isn’t lined by Social Safety.

Under, we’ll discover two completely different eventualities:

- Claiming at Age 62: On this case, you obtain a smaller Social Safety advantage of $22,500 per yr however start receiving it earlier. Your portfolio might want to cowl the remaining $37,500 per yr to satisfy your $60,000 spending objective.

- Delaying till Age 70: Delaying will increase your annual Social Safety profit to $39,600, however you’ll must fund your total $60,000 residing bills out of your portfolio till you attain age 70.

The desk beneath compares these eventualities:

| Situation | Begin Age | Annual Social Safety Profit | Portfolio Withdrawal Required |

| Claiming Early (62) | 62 | $22,500 | $37,500 |

| Delaying (70) | 70 | $39,600 | $60,000 (till 70) |

Portfolio Spending with Early Claiming

Within the first state of affairs, you determine to say Social Safety at age 62. This supplies an annual advantage of $22,500, which implies it’s worthwhile to withdraw $37,500 out of your funding portfolio every year to satisfy a $60,000 spending want.

The benefit right here is that you simply begin receiving cash earlier, which reduces the instant want for giant portfolio withdrawals. Nonetheless, the decrease Social Safety profit means you’ll must proceed relying extra closely in your portfolio all through retirement, which is able to enhance the distribution charge and should put extra strain in your investments over time. On this state of affairs, your preliminary portfolio withdrawal charge is roughly 4.7% ($37,500 / $800,000), which will increase the danger of depleting your property, particularly during times of poor market efficiency.

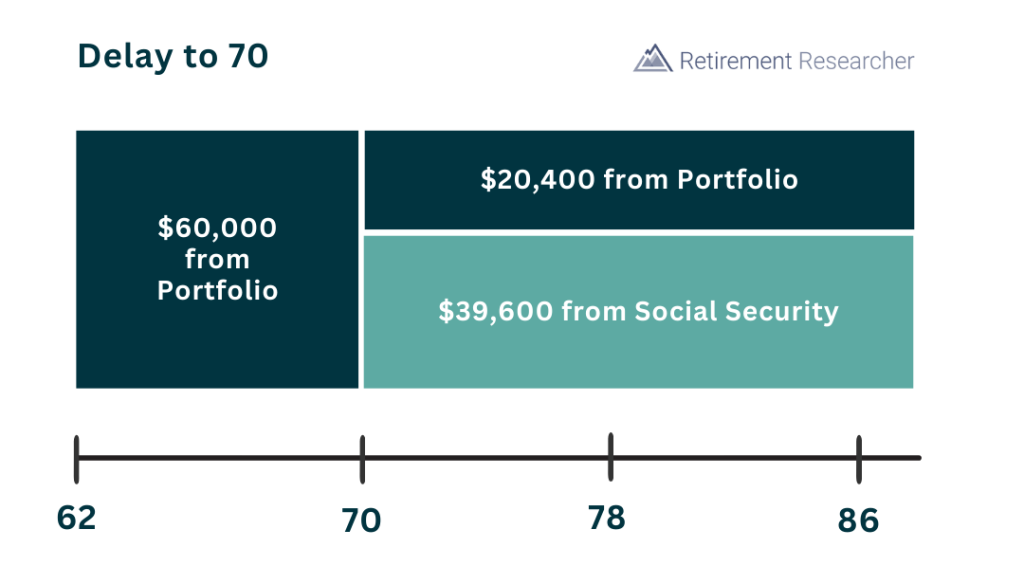

Delaying Advantages Till Age 70

Within the second state of affairs, you delay claiming Social Safety till age 70, which ends up in a considerably increased advantage of $39,600 per yr. To cowl your spending wants between ages 62 and 70, you absolutely fund your way of life out of your portfolio, withdrawing $60,000 per yr.

As soon as you start receiving Social Safety at 70, your annual withdrawals from the portfolio drop to $20,400. This may help protect your portfolio over the long run, particularly when you stay past average life expectancy.

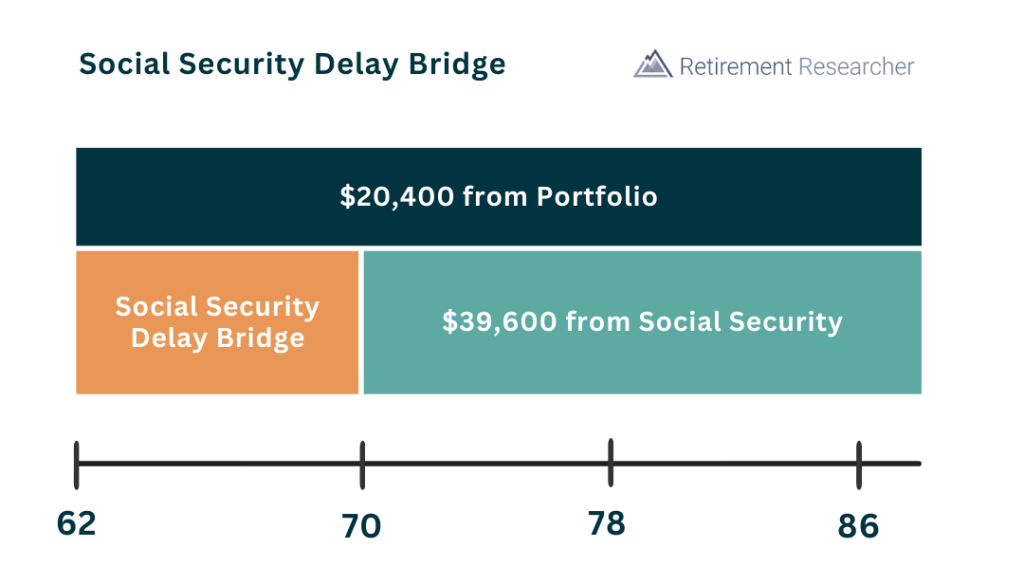

Utilizing a Social Safety Delay Bridge

A 3rd technique entails making a Social Safety Delay Bridge. This technique entails setting apart a portion of your portfolio particularly to cowl your spending wants between ages 62 and 70, permitting you to delay claiming Social Safety with out growing your annual withdrawals.

By utilizing a bridge, you primarily pre-fund the hole years – sometimes with a bond ladder – which lets you reap the benefits of the upper profit at age 70 whereas avoiding extreme withdrawals early on. Whereas this does imply that you’ll cut back the dimensions of your funding portfolio, it additionally implies that you’ll cut back the magnitude of your sequence of returns risk as you aren’t spending out of your risky funding portfolio.

The price of making a Social Safety Delay Bridge will depend upon the present market situations, in addition to how a lot earnings you want to obtain. However for instance, say you want to create a TIPS bridge that may present $39,600 per yr (the quantity of your Social Safety advantages when you declare at age 70) beginning at age 62. We’ll additionally assume that this bridge will earn a 0% actual rate of interest (you will need to be aware that this can be a very conservative assumption, and it is rather probably that an actual bridge would supply a constructive actual yield).

Which means at age 62 you would wish to put aside $316,800 ($39,600 x 8 years) to buy the TIPS Social Safety Delay Bridge.

With the bridge technique, you withdraw $20,400 out of your portfolio every year all through retirement, because the bridge funds the hole till age 70. The required withdrawal charge to satisfy the spending objective all through retirement is now:

Withdrawal Charge = ($60,000 – $39,600) / ($800,000 – $316,800) = 4.22%

On this instance, delaying Social Safety allowed the withdrawal charge to drop from 4.69% to 4.22%.

This improves retirement sustainability. The funding portfolio is much less more likely to be depleted and extra earnings stays accessible by the upper Social Safety profit within the occasion that the portfolio is depleted. In different phrases, working out of economic property is each much less more likely to occur and fewer damaging when it does occur.

Permitting for a similar chance of portfolio depletion, spending may very well be elevated by greater than 11% to $66,682 with the intention to use the identical 4.69% withdrawal charge as when claiming early. Then, 76% extra earnings continues to be accessible than in any other case within the occasion of portfolio depletion. That is the completely enhanced way of life doable with Social Safety delay.

Influence of Social Safety Delay on Retirement Withdrawal Methods

The important thing takeaway right here is that delaying Social Safety can act as a helpful funding in your retirement safety. The extra earnings from delaying advantages reduces your reliance on portfolio withdrawals, which will be particularly helpful if market returns are decrease than anticipated or when you stay longer than common.

| Influence of Social Safety Delay on Retirement Withdrawal Charges | Declare at Age 62 | Declare at Age 70 |

| Spending Objective | $60,000 | $60,000 |

| Social Safety Profit | $22,500 | $39,600 |

| Portfolio Withdrawal | $37,500 | $20,400 |

| Funding Portfolio | $800,000 | $800,000 |

| Set Apart for Social Safety Delay | $0 | $316,800 |

| Remaining Portfolio | $800,000 | $483,200 |

| Withdrawal Charge | 4.69% | 4.22% |

The magnitude of the distinction could be bigger if the shopper’s spending objective and asset base have been smaller relative to the Social Safety advantages, and vice versa.

For this technique to work successfully, the general spending objective can’t be too giant with respect to the dimensions of the monetary portfolio. For example, if the portfolio was $300,000, there wouldn’t be sufficient to create the delay bridge. In any other case, a big sufficient portfolio will enable for Social Safety delay to scale back the required portfolio withdrawal charge. And if the portfolio shouldn’t be giant sufficient, it’s extra of a mirrored image that the general spending objective shouldn’t be real looking, reasonably than an indictment towards Social Safety delay. Although, severely underfunded retirees with out options could also be forced to claim Social Security early as a result of they can’t in any other case fund themselves by age 70.

Conclusion

Delaying Social Safety advantages can enhance the sustainability of a retirement earnings plan or enhance spending energy whereas sustaining the identical success chance. Initially, retirees must withdraw extra from their portfolio till Social Safety begins, however they will cut back withdrawals as soon as the advantages begin. Nonetheless, relying solely on a risky funding portfolio shouldn’t be foolproof, as a poor sequence of returns early in retirement might deplete the portfolio and lock in losses. To mitigate this threat, retirees can carve out property from the primary funding portfolio to create a Social Safety delay bridge. Alternatively, retirees might use different buffer assets, equivalent to residence fairness by a reverse mortgage or life insurance coverage, to assemble this bridge.

Social Safety is a essential element of retirement earnings, and the choice of when to say advantages can have a big influence in your monetary future. By contemplating completely different claiming methods, equivalent to early claiming, delaying, or utilizing a Social Safety Delay Bridge, you possibly can higher align your retirement earnings together with your objectives and threat tolerance.

By thoughtfully contemplating when to say Social Safety, you possibly can considerably improve your retirement safety. Delaying advantages isn’t at all times simple, however the potential rewards—lowered reliance in your portfolio, elevated lifetime earnings, and larger flexibility—could make it a robust instrument in your retirement planning. Every individual’s state of affairs is exclusive, so it’s essential to guage your choices rigorously and select the method that aligns greatest together with your objectives and monetary circumstances.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/10/Bridge-Gap-2-1024x810.jpg)