Planning for inflation is essential when designing your retirement plan. Whereas the common annual inflation charge from 1926 to 2023 was round 3.01%, expectations for the longer term are considerably completely different. On this article, we discover how Treasury Bonds and TIPS (Treasury Inflation-Protected Securities) assist us gauge future inflation expectations and the way this impacts retirement planning.

Retirees Are Extra Weak to Inflation Than Common

For individuals targeted on retirement as this huge monetary focus, inflation is completely one thing to be enthusiastic about.

We frequently speak about how you are different from the average investor. And one of many basic examples of that is that retirees are typically considerably extra uncovered to inflation than the common investor.

There are a variety of causes for this: you’re (or could possibly be quickly) spending your financial savings, your dependable revenue sources is probably not adjusted for inflation (or could solely alter with a major lag), or you could have a lower ratio of stocks to bonds than different buyers (we’ll speak about this one in a bit). However the upshot is that prime ranges of inflation can put a pressure in your retirement revenue plan.

Addressing Inflation Fears After the Pandemic

And that is exacerbated by the excessive ranges of inflation that we noticed following the pandemic. There have been quite a lot of causes for why we noticed excessive inflation, however fortunately inflation charges have come down considerably.

Presently we’re seeing inflation charges which might be effectively under the historic common, and it seems as if that may proceed into the foreseeable future.

Utilizing the Market to Estimate Future Inflation

We are able to use info from the market to estimate future inflation. By wanting on the distinction between the yields on Treasury bonds and the yields on TIPS (Treasury Inflation Protected Securities), the market is telling us what it expects inflation to look like by means of time.

The logic right here is straightforward. The one significant distinction between “regular” Treasury bonds and TIPS is the inflation safety constructed into TIPS, so the distinction in value is how a lot the market is keen to pay to take away inflation threat over the lifetime of the bond. In different phrases, what the markets suppose inflation might be throughout that interval.

Present Inflation Charges

Let’s begin by taking a look at what the numbers are telling us presently.

Beneath is the implied annualized inflation charge primarily based on the distinction between Treasury Bond and TIPS yields.

As we are able to see, the implied future inflation charges are staying in a fairly tight vary going ahead – between 2.14% per 12 months (for the 5 and seven 12 months time intervals) and a pair of.39% per 12 months (over the subsequent 20 years).

Now, it’s vital to acknowledge that these are annualized charges – what the markets count on to occur over the complete time interval – not essentially that we’ll have the identical inflation charge annually over these intervals. In truth, it will probably’t work that manner since the entire time intervals begin right this moment and go ahead. Despite the fact that we’re taking a look at a fairly tight vary on the estimates, the numbers aren’t all the identical.

Understanding Ahead Charges

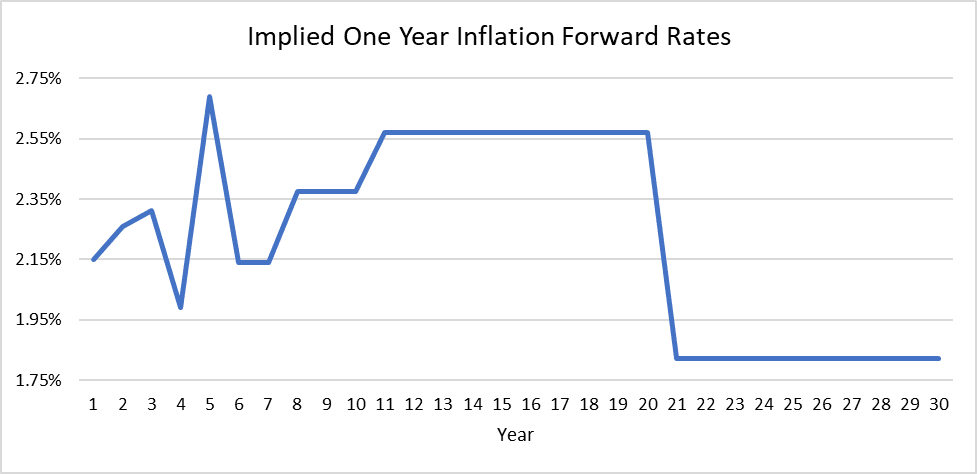

Despite the fact that we’re (semi)straight taking a look at anticipated annualized inflation charges, we are able to truly pull the numbers aside and take a look at 12 months by 12 months estimates of inflation by means of one thing referred to as Ahead Charges.

Let’s say that we wish to know what to anticipate by way of inflation over the subsequent three years. We count on that over the subsequent three years the annualized inflation charge will come out to 2.24% primarily based on the unfold between three 12 months Treasury bonds and three 12 months TIPS. But it surely’s fairly protected to imagine that we gained’t have inflation of precisely 2.24% annually for the subsequent three years.

To see how ahead charges work, think about a bond maturing in three years. Like all bond, it’s a promise that you just’ll get a sure sequence of coupon funds, after which the face worth when the bond matures (on the finish of the three years).

Nicely, one other manner to consider it’s truly as a sequence of three one 12 months bonds. In different phrases, you should purchase a one 12 months bond right this moment, after which one other one 12 months bond when the primary one matures, after which lastly a 3rd one 12 months bond when the second matures.

Assuming that markets are pricing things appropriately, this sequence of three bonds needs to be economically equal to the one three 12 months bond. If that is true, then we are able to do a little bit of math, and work out the worth of every particular person bond to somebody right this moment. I do know that this will sound somewhat bit convoluted, nevertheless it’s an extremely highly effective approach that enables us to do some actually cool issues.

Implied Annual Inflation Charges

However for our functions, these ahead charges enable us to estimate the 12 months by 12 months inflation charges. So let’s return to that three 12 months inflation charge.

We all know that the market is estimating that over the complete three 12 months interval, the annualized inflation charge goes to be 2.24%. However we even have details about what the market expects the inflation charge to be over the subsequent 12 months (2.15%) and over the subsequent two years (2.20% annualized).

Stringing these numbers collectively we are able to work out what to anticipate on an annual foundation. So let’s begin at first.

The market is anticipating the inflation charge over the subsequent 12 months to be 2.15%, which we are able to take as our base quantity since we’re taking a look at this by way of years. However we additionally know that the market is anticipating inflation to be 2.20% over the subsequent two years.

The inflation charge within the second 12 months might be no matter makes the maths for each of these statements true. On this case, that implies that the markets expect the inflation charge within the 12 months after subsequent to be 2.26%.

After which we are able to the identical factor for the third 12 months (which comes out to 2.31%), after which on down the road.

Once we do out the entire math, it seems like this.

(For those who actually wish to dive into the maths right here, all of this information is from our Implied Inflation Calculator that’s accessible to members of the Retirement Researcher Academy.)

It’s not fairly as tight of a variety because the smoothed out annualized numbers, nevertheless it’s nonetheless a fairly tight vary. In truth, the very best anticipated annual inflation charge is just 2.69% 5 years out from now (and keep in mind, the historic common annual inflation charge is 3%).

Since retirees are extra uncovered to inflation threat than the common investor that is actually nice information for individuals targeted on retirement, nevertheless it doesn’t imply that we needs to be complacent. We nonetheless wish to guarantee that our retirement plans are capable of deal with inflation – particularly the risk of unanticipated inflation.

Constructing Inflation Into Your Retirement Planning

All of that is attention-grabbing info, however we want to have the ability to apply it to our retirement income plan for it to be helpful. And, as a lot enjoyable as it will be, utilizing a distinct inflation charge for annually could be somewhat unwieldy.

As a baseline, you’ll possible wish to begin with an inflation charge tied to your planning horizon. For those who’re 90, you’ll in all probability be extra targeted on shorter time period inflation than somebody who’s of their 60s. From there, you possibly can both use the market’s anticipated inflation charge, or bump it as much as make the evaluation extra conservative.

One other step that you would be able to take is to run a number of situations of your plan and range the inflation charge (together with doubtlessly various it over time in your plan) to see how that may have an effect on issues.

Whereas it’s possible {that a} larger inflation charge isn’t going to do your plan any favors, each plan will reply in another way to inflation. Seeing how your outcomes change will enable you to perceive simply how uncovered to inflation you’re.

However how will we go about coping with this threat? If inflation has a big effect in your retirement revenue plan, what are some issues that you are able to do to handle that? If we deal with the asset facet of the equation, I break issues into two classes: oblique methods, and direct methods.

Oblique Inflation Safety Methods

Oblique inflation protections are issues which might be delicate to inflation and shortly incorporate modifications in future anticipated inflation.

Whereas they is probably not particularly monitoring inflation, these property (partially) transfer primarily based on what inflation is prone to do sooner or later. If the estimate of the 5 12 months inflation charge modifications, the value of those property will change, no less than to some extent, in response to this. This class, at it’s most broad definition, incorporates just about all monetary property, however there are two that I actually wish to deal with: shares and quick time period bonds.

Shares are nice, if extremely noisy, hedges for inflation. Except for having larger anticipated returns (which make up for lots of sins), there are a few completely different mechanisms that tie shares to inflation. A very powerful of those is that inflation is figured into that anticipated return. In a better inflation surroundings, buyers demand a better anticipated return to carry shares.

The story is just about the identical with quick time period bonds. When bond buyers are deciding how a lot they’re willing to pay for a bond (in different phrases, the money flows from the bond), they think about how a lot they suppose these funds will truly be value once they obtain them.

What makes quick time period bonds particular is that frequency with which the portfolio is bringing that info to bear. The bonds held in a brief time period bond portfolio flip over extra shortly than the bonds in a long run portfolio – and that implies that new details about inflation (and all the things else) will get absorbed extremely shortly.

Direct Inflation Safety Methods

On the direct facet are issues which might be primarily based on precise inflation. These are issues like inflation riders on annuities, TIPS, or I-bonds.

The specifics of annuity inflation riders will depend upon the person contract, and might range extensively, so we’ll put them to the facet right here (however they are often nice instruments in the proper scenario).

TIPS and I-bonds are each US Treasury securities. We talked about TIPS earlier, however I-bonds, or extra technically Sequence I Financial savings Bonds, function on primarily the identical concept. Their funds change with the precise inflation charge that we’re experiencing. When we have now larger inflation, their funds enhance. TIPS do that by adjusting the principal quantity of the bond, and I-bonds do it by together with each a base mounted rate of interest fee, in addition to a variable rate of interest fee primarily based on inflation.

The large distinction between the 2 is that there are fairly strict limits on the quantity of I-bonds that you would be able to purchase directly and what accounts you possibly can maintain them in, whereas TIPS are marketable securities which might be simply on the market so that you can purchase and promote as you please. Then again, I-bonds are likely to pay (a lot) larger rates of interest.

Designing Your Portfolio (and Retirement Plan) for Inflation

Determining tips on how to stability the entire competing calls for in your plan is difficult. Eradicating inflation threat out of your plan isn’t free. As you’re enthusiastic about how uncovered you’re to inflation threat, and the way you wish to cope with it, it is advisable maintain that price in thoughts. And this price can are available many types.

The prices with direct safety are, effectively, fairly direct. An insurance coverage firm goes to cost you for an inflation rider in your annuity. On common, TIPS could have decrease yields than “regular” US Treasury bonds. They usually simply make I-bonds exhausting to make use of. However even with the sources of oblique inflation safety, there are nonetheless alternative prices and tradeoffs to think about. You solely have a lot house in your portfolio, so it’s all the time a balancing act.

You have to take a look at your portfolio as a cohesive complete. In case you are targeted on retirement, inflation might be a threat that you just wish to handle. However there are different dangers that it is advisable cope with, as effectively. You have to discover the combo of options (and dangers) that you’re snug with, and that may enable you to keep disciplined to your total retirement revenue plan.

Retirement planning is about controlling what you possibly can and being ready for what you possibly can’t. With inflation, it’s clever to construct flexibility into your plan, making certain that irrespective of how the economic system shifts, you stay on observe to the retirement way of life you need.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/10/Blow-up-balloon-1024x810.jpg)