PGHunt24 wrote: ↑Sat Sep 14, 2024 3:30 pm

Now that NAV’s are beginning to heal and distributions are beginning to quiet down with Bond Funds, I used to be on the lookout for recommendation on whether or not I ought to exchange my Bond Funds with one thing much less delicate to rates of interest with a greater return (if that exists). 1/2 of my portfolio is in 3 funds, BNDX, VFIDX and VFSUX. That is all certified cash totaling $500 Okay. I’ve owned these funds for nearly 9 years and are nearly at breakeve from what I paid for them. Over this time interval, the distributions have been comparatively low, apart from latest instances. Since inception, these funds have yielded 2.35, 4.66 and three.07 % respectively.Are there higher funds to get a greater return on this 1/2 of my portfolio, or am I lacking one thing? I’m 73 years previous and wish to see this half of my portfolio do higher in NAV and dividend or coupons or distributions or curiosity, no matter you need to name it. In different phrases make higher cash. At age 73 I do not need to undergo one other prolonged time frame with this sort of expertise. Any concepts can be appreciated. Thanks.

first, are you certain your three funds bndx, vfidx and vfsux have solely simply “damaged even” over the previous 9 years?? As a result of that is not what I see. You did not give us essential items of data to know for certain:

1. the precise date you made your buy in these funds (if it was even simply as soon as and no extra)

2. did you reinvest the dividends or take them as money?

3. Are you trying on the NAV over the previous 9 years or the whole return (which incorporates the dividends)?

4. did you make investments equal quantities in every of those three or totally different percentages in every?

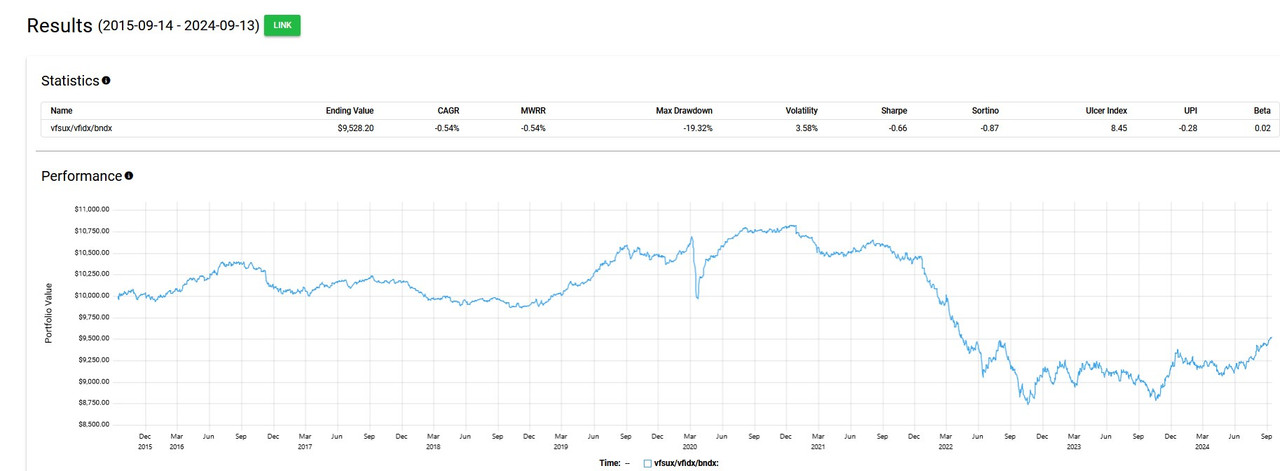

Since we do not know the solutions to those questions, I am going to simply take a look at the three going again 9 years from at present and divide your cash (the 50% that was invested in these) in three equal quantities. If I try this, it seems like these three funds in whole are UP 24.84%. That is totally different from merely breaking even over the previous 9 years, do not you suppose? (see beneath):

however perhaps you are taking a look at your efficiency with out the dividends reinvested since you took them out. If we take a look at the efficiency with out dividends reinvested it does appear like you have solely damaged even:

however you are clearly not trying on the complete image are you? I imply it isn’t such as you DIDN’T obtain these dividends, proper?

However here is one thing much more vital to know.

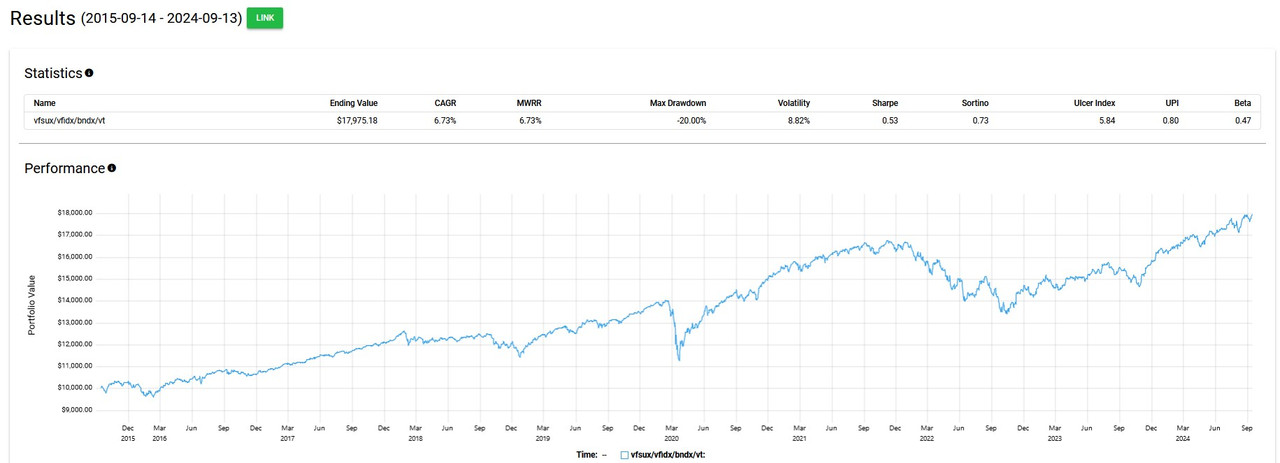

Try to be involved with the general return of your portfolio reasonably than the part elements of the portfolio. Let’s use the identical funds over the previous 9 years however as you say name that fifty% of your portfolio. Then let’s assume the opposite 50% of your portfolio is in shares, particularly VT the whole world inventory market index fund. How would the efficiency have been over the identical 9 years? You’d have been UP 79.75% over these 9 years.

So perhaps don’t be concerned about elements of your portfolio and take a look at the general efficiency of your portfolio as an alternative. You possibly can continously tinker with the part elements, however is that useful? I actually do not suppose so. The allocation (proportion in shares and bonds general) can be a better determinent anyway of your efficiency reasonably than the precise funds you select, particularly for those who’re tinkering across the margins.

that is the second time in just a few days that, first, somebody thinks their portfolio (or a part of it) did one thing it did not even do. After which they need to change their holdings due to what they thought it did that it did not. Folks have a tough time simply staying in their seat, do not they?

what do you suppose?

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/1726546062_994_Replace-Bond-Funds-Bogleheadsorg-1024x379.jpg)