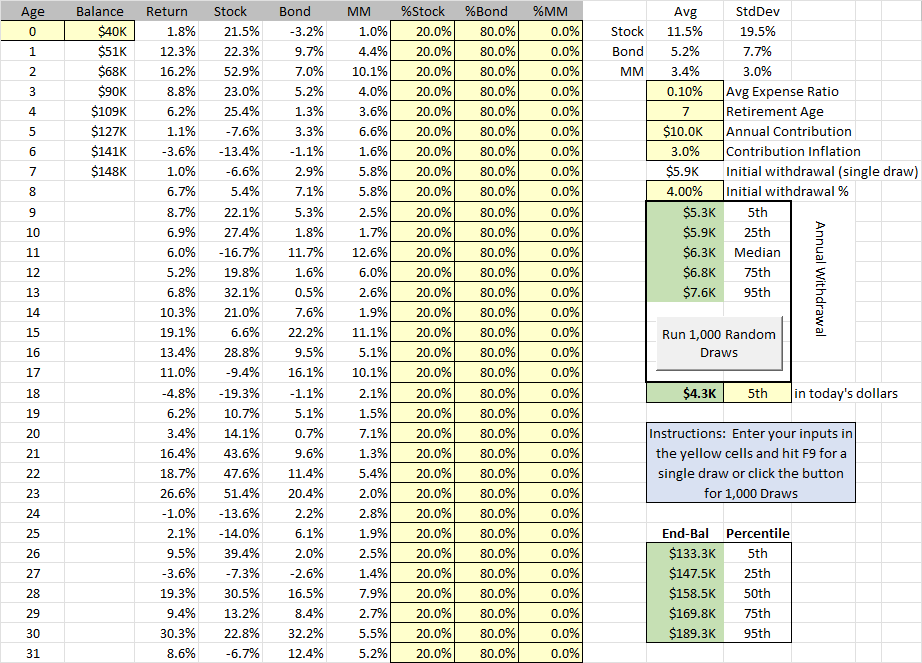

As @invest4 mentioned, saving for a house is usually a brief (<5y) time frame which is finest for money devices (CDs, MMF, T-Payments). Nevertheless, your time frame appears extra like 5-10 years, so let’s take a look at the vary of Monte Carlo outcomes by probability/percentile for simply sitting in money, Asset Allocation (AA) of 20/80 shares/bonds (not money), and 40/60 shares/bonds over a 7-year interval assuming an preliminary steadiness of $40K, $10K/yr contributions rising with wage raises by +3%/yr, and an expense ratio of 0.10%.

Money (3m T-Payments)

Finish-Bal Percentile

$131.8K fifth

$136.3K twenty fifth

$140.3K fiftieth

$145.0K seventy fifth

$153.8K ninety fifth

20/80

Finish-Bal Percentile

$133.3K fifth

$147.5K twenty fifth

$158.5K fiftieth

$169.8K seventy fifth

$189.3K ninety fifth

40/60

Finish-Bal Percentile

$129.7K fifth

$149.5K twenty fifth

$164.1K fiftieth

$182.1K seventy fifth

$209.8K ninety fifth

In the event you’re involved a couple of unhealthy sequence of returns, the conservative view is to maximise the worst fifth percentile final result, which is a 20/80 inventory/bond break up ($133K @ 20/80 is greater than $132K for money and $130K for 40/60, though these are all very shut). That is in keeping with the environment friendly frontier asset allocation threat/reward chart beneath that reveals any bond allocation > 80% is dominated by an AA with much less than 80% bonds (related threat however larger reward), so keep away from the crimson dots if in case you have at least a 7y time frame. To reiterate in case your time frame is <5y try to be 100% MMF. A really optimistic view is to imagine the chance of a coin-toss on the fiftieth percentile steadiness, however do you actually wish to plan on a 50% likelihood of extra and a 50% likelihood of much less, or wouldn’t it be higher to imagine the fifth percentile final result with a 95% likelihood of reaching that steadiness or larger? The longer the time frame the larger the magnitude distinction between projected balances at fifth, fiftieth, and ninety fifth percentiles.

A ladder with long-term notes (20 or 30 yr T-Bonds) is prone to be fairly risky as would an ETF. If you are going to take into account a ladder of particular person Notes (not bonds), then use an idea referred to as period matching, which might if you happen to want the cash in precisely 7 years, then you definately’d put all $40K into 7y T-Notes. Any new cash would go into 5y T-Notes, till your time frame is <5y, then you definately transition new cash to 3y T-Notes, after which 2y T-Notes, then 52w T-Payments. The issue with period matching is that you might want to know the date you are planning to spend the cash and you do not, so I counsel you keep away from a ladder of particular person Treasuries and simply stick to both a MMF or pair of inventory & bond index funds.

———-

The tip-balance by probability percentiles I listed above are from my Accumulation Monte Carlo. The picture for the 20/80 case is given beneath together with hyperlinks to the mannequin if in case you have an Excel license, in addition to different web-based fashions that may be of curiosity so that you can play with (e.g., use money as an alternative of bonds, change the annual contribution/enhance $ and %, change the time frame to 5y or 10y, and so on.).

Knowledge and Fashions I take advantage of for Monte Carlo:

NYU Data Set 1928-2017 with Mannequin Matches

Accumulation Monte Carlo <-image above is that this mannequin

Withdrawal Monte Carlo

You may want a MS Excel license; obtain to your native machine and allow macros (required for the 1,000 random trials and outcomes aggregation).

I am utilizing my very own mannequin as I wish to know what’s beneath the hood, however there are different fashions I like which have public dealing with web site interfaces:

Portfolio Visualizer’s Monte Carlo (with distribution modeling quite than the historic returns array),

FiCalc (straightforward interface, however solely historic knowledge array),

TPAW (historic knowledge, however adjusted to keep away from limitations of a random index into the historic array),

and lots of others right here appear to love FireCalc (additionally historic knowledge, however heaps extra inputs to tailor to your state of affairs).

I do not look after a random index into the historic array of returns, in comparison with distribution modeling, as famous on this thread HERE.

Do not do what Bogleheads let you know. Hearken to what we are saying, take into account different sources, and make your individual selections, since it’s a must to dwell with the dangers & rewards (not us or anybody else).

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/Saving-for-house-down-payment-with-unknown-timeline.png)