Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

Financial institution of Canada governor Tiff Macklem has opened the door to accelerating the tempo of rate of interest cuts, signalling policymakers may change to jumbo 50 foundation level strikes ought to development disappoint.

The G7 financial system grew by an annualised price of two.1 per cent over the second quarter, however considerations are mounting that falling oil costs, greater unemployment and decrease ranges of immigration may tip Canada near stagnation.

Macklem advised the Monetary Occasions that rate-setters are more and more involved about Canada’s labour market and the potential of decrease costs for crude hitting the financial system.

The Canadian central financial institution has led the way on rate of interest reductions, chopping by 1 / 4 level of their three conferences since June to convey borrowing prices down from a peak of 5 per cent to 4.25 per cent.

With inflation, at 2.5 per cent, now near the Financial institution’s 2 per cent aim, Macklem stated in London final week that there was now room to step up the tempo of price cuts.

“As you get nearer to the [inflation] goal, your threat administration calculus adjustments,” Macklem stated. “You grow to be extra involved concerning the draw back dangers. And the labour market is pointing to some draw back dangers.”

Canadian unemployment reached 6.6 per cent in August from a low of 4.8 per cent in 2022, a a lot quicker improve than within the US. American unemployment against this has risen solely to 4.2 per cent from a pandemic-era low of three.4 per cent.

The US Federal Reserve is anticipated to chop rates of interest for the primary time in additional than 4 years on Wednesday, from a 23-year-high vary of 5.25 to five.5 per cent.

Canadian job emptiness and hiring charges have additionally fallen beneath their pre-pandemic norms in contrast to these within the US.

The Financial institution of Canada nonetheless expects the financial system to broaden by 2 per cent in 2024 and by 2.1 per cent subsequent yr.

But when development doesn’t materialise as anticipated, “it could possibly be applicable to maneuver quicker [on] rates of interest,” Macklem stated. He famous that there was presently “sufficient slack within the [Canadian] financial system to convey inflation again down to focus on”.

“We don’t need to see extra slack,” he stated, implying that the central financial institution would reduce charges extra aggressively, ought to development disappoint.

Issues concerning the well being of the Canadian financial system have unfold throughout the enterprise and monetary neighborhood.

Talking on the Canada Membership in Toronto on Tuesday, David McKay, the pinnacle of the Royal Financial institution of Canada, one of many world’s largest banks, stated Canada was “heading within the mistaken course”.

Added to the record of draw back dangers worrying the governor is an oil price that has fallen sharply in latest weeks. The G7 financial system is a big internet power exporter, with the oil and fuel trade accounting for greater than 3 per cent of gross home product in 2022, in line with the Canadian Affiliation of Petroleum Producers.

Macklem famous that Canadian oil producers are used to fluctuating world costs, however that “[i]f it’s a very sharp cycle, it’s going to have a huge impact”.

The governor stated the central financial institution had not but selected a quicker path of price cuts and there have been nonetheless upside dangers to inflation that it wanted to observe — together with shelter costs, predominantly lease and mortgage curiosity prices.

The Canadian rental market has been tight because of provide constraints which have been exacerbated by latest massive will increase in immigration. Hire costs rose near 9 per cent within the yr to July. Canada added about 500,000 immigrants, a traditionally excessive stage towards a inhabitants of 39mn, in 2023.

“We count on to see lease value inflation come down,” Macklem stated, although he acknowledged “that would take a while”.

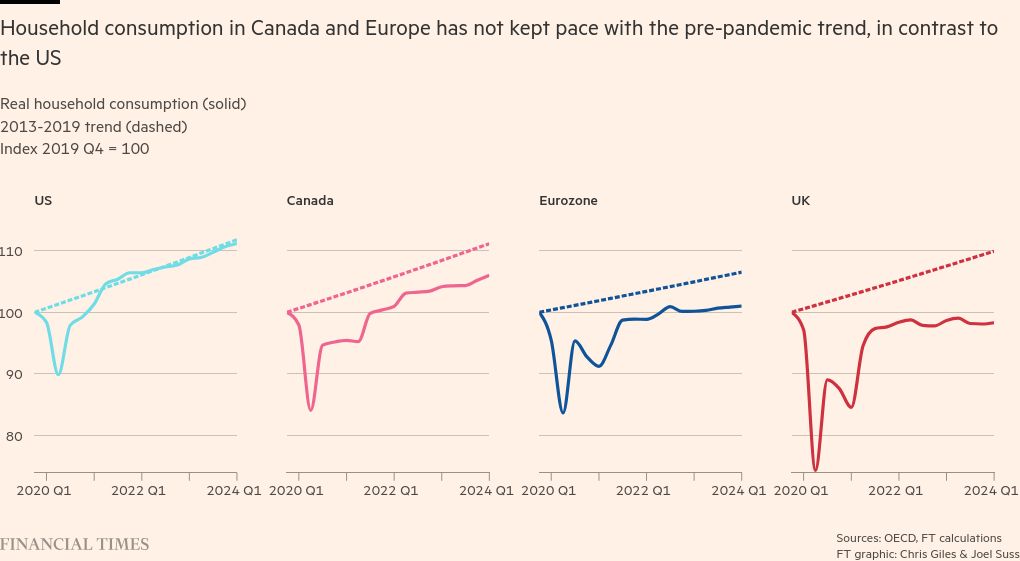

In the meantime, Canadian productiveness development has been surprisingly weak because the pandemic, underscoring its financial troubles relative to the US.

Macklem stated: “What we thought was that as these provide chain disruptions are labored out . . . new staff get skilled, you must see some pick-up in productiveness development. That isn’t what occurred in Canada, and in reality it’s not what’s occurred within the UK. It’s not what’s occurred in Europe . . . ”.

He added: “There’s one thing concerning the pandemic that has actually harm productiveness development in lots of our nations . . . the US is the exception.”

Financial output has been held up in Canada by a big influx of immigrants.

However that will change going ahead, as the federal government of Canada recently announced curbs to short-term international staff.

Whereas a discount in immigration may take some warmth out of the Canadian rental market, it’s anticipated to make the financial scenario worse.

Macklem hoped that the discount in client demand implied by fewer immigrants could be offset by easing borrowing prices. “Our expectation is you’re going to begin to see per capita consumption arising.”

Further reporting by Ilya Gridneff in Toronto