PGHunt24 wrote: ↑Sat Sep 14, 2024 3:30 pm

Now that NAV’s are beginning to heal and distributions are beginning to calm down with Bond Funds, I used to be searching for recommendation on whether or not I ought to change my Bond Funds with one thing much less delicate to rates of interest with a greater return (if that exists). 1/2 of my portfolio is in 3 funds, BNDX, VFIDX and VFSUX. That is all certified cash totaling $500 Okay. I’ve owned these funds for nearly 9 years and are virtually at breakeve from what I paid for them. Over this time interval, the distributions have been comparatively low, apart from latest occasions. Since inception, these funds have yielded 2.35, 4.66 and three.07 % respectively.Are there higher funds to get a greater return on this 1/2 of my portfolio, or am I lacking one thing? I’m 73 years outdated and wish to see this half of my portfolio do higher in NAV and dividend or coupons or distributions or curiosity, no matter you need to name it. In different phrases make higher cash. At age 73 I do not need to undergo one other prolonged time period with this type of expertise. Any concepts can be appreciated. Thanks.

first, are you positive your three funds bndx, vfidx and vfsux have solely simply “damaged even” over the previous 9 years?? As a result of that is not what I see. You did not give us vital items of data to know for positive:

1. the precise date you made your buy in these funds (if it was even simply as soon as and no extra)

2. did you reinvest the dividends or take them as money?

3. Are you trying on the NAV over the previous 9 years or the overall return (which incorporates the dividends)?

4. did you make investments equal quantities in every of those three or completely different percentages in every?

Since we do not know the solutions to those questions, I am going to simply have a look at the three going again 9 years from as we speak and divide your cash (the 50% that was invested in these) in three equal quantities. If I try this, it appears like these three funds in complete are UP 24.84%. That is completely different from merely breaking even over the previous 9 years, do not you suppose? (see beneath):

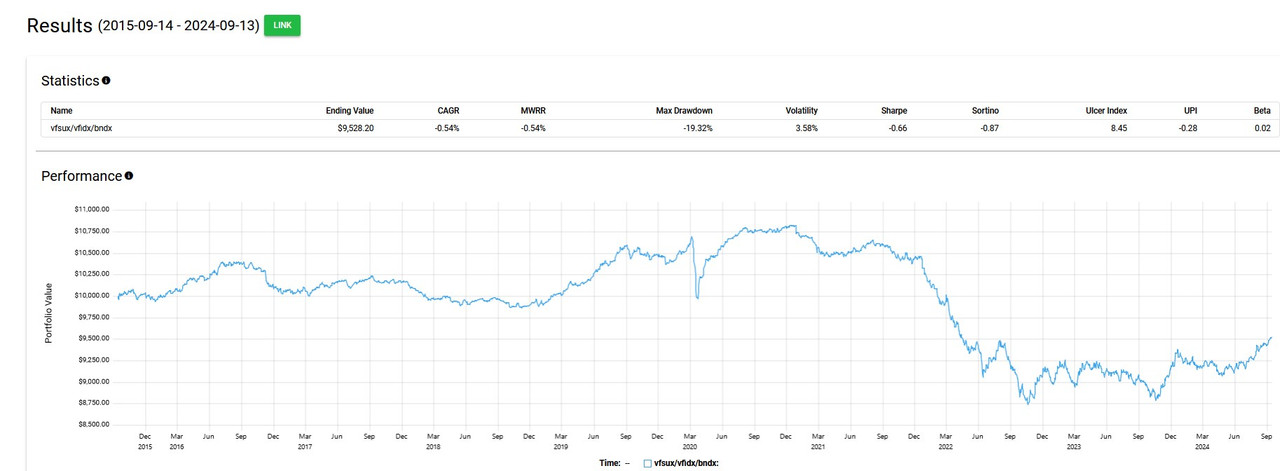

however possibly you are taking a look at your efficiency with out the dividends reinvested since you took them out. If we have a look at the efficiency with out dividends reinvested it does seem like you have solely damaged even:

however you are clearly not trying on the complete image are you? I imply it is not such as you DIDN’T obtain these dividends, proper?

However this is one thing much more essential to know.

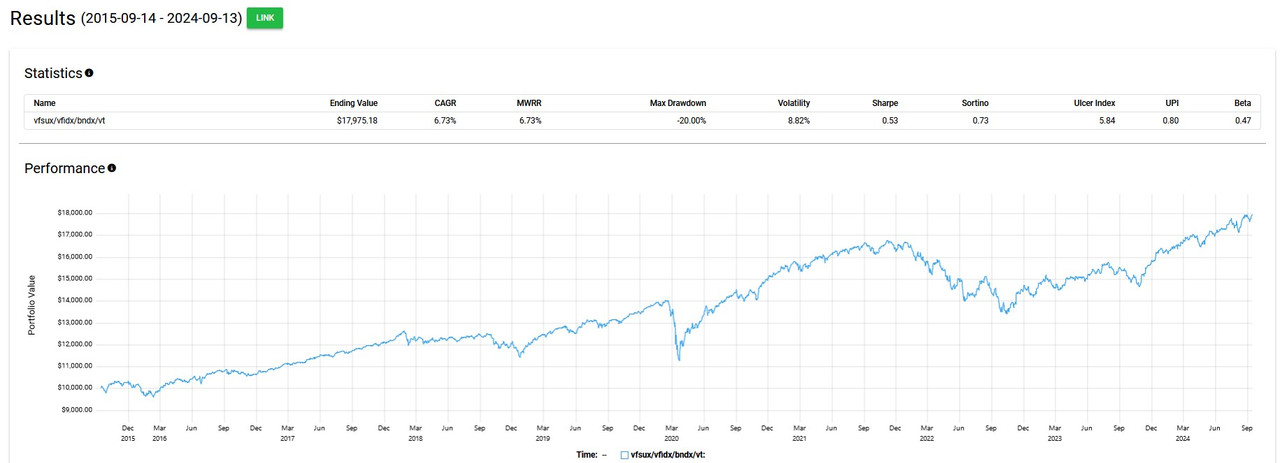

Try to be involved with the general return of your portfolio reasonably than the part components of the portfolio. Let’s use the identical funds over the previous 9 years however as you say name that fifty% of your portfolio. Then let’s assume the opposite 50% of your portfolio is in shares, particularly VT the overall world inventory market index fund. How would the efficiency have been over the identical 9 years? You’d have been UP 79.75% over these 9 years.

So possibly don’t fret about components of your portfolio and have a look at the general efficiency of your portfolio as an alternative. You may continously tinker with the part components, however is that useful? I actually do not suppose so. The allocation (share in shares and bonds general) will probably be a larger determinent anyway of your efficiency reasonably than the particular funds you select, particularly should you’re tinkering across the margins.

that is the second time in a number of days that, first, somebody thinks their portfolio (or a part of it) did one thing it did not even do. After which they need to change their holdings due to what they thought it did that it did not. Individuals have a tough time simply staying in their seat, do not they?

what do you suppose?

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/1726367969_673_Replace-Bond-Funds-Bogleheadsorg-1024x379.jpg)