As unusual as it could sound, incomes monetary freedom is so much simpler for sure folks than claiming that freedom as soon as they’ve earned it. And if the next assertion rings true to you, chances are you’ll be affected by this identical hardship:

“I feel I’m near having sufficient cash to leap into early retirement, however not fairly.

So I’m simply working yet one more yr and beginning yet one more aspect hustle and buckling down additional exhausting to be extra sure.”

It sounds rational, proper? In any case, you possibly can by no means be too cautious, because the saying goes.

However the issue is that these folks maintain repeating the mantra no matter how a lot cash they’ve, and no matter their precise residing bills. Irrespective of how vivid their monetary image is, they at all times discover a option to undervalue their financial savings and overestimate their future bills, simply in case of the sudden.

And by tilting the stability ever additional within the course of “security”, they overlook about what must be on the opposite aspect of the size, which is “profiting from your finite time on this pretty planet.”

This occurs far more than you would possibly assume. Each week, it’s in my electronic mail inbox and my in-person conversations with folks I meet. This concern is even prevalent amongst a few of my real-life associates, so let’s take a look at a few thinly disguised examples from that group to see a few of the signs (and a attainable treatment for) this famed affliction of One Extra Yr Syndrome.

Alina’s Anemic Withdrawal Fee

Alina is a currently-single physician in a irritating however properly paid space of follow, age 50 with one grown baby. She has about $2 million in investments, and at present spends about $50,000 per yr, a stage which incorporates just about the whole lot that’s essential to her.

In accordance with The 4% Rule, Alina’s nest egg will present a reasonably dependable earnings of roughly $80,000 per yr for the remainder of her life. Or to place it one other means, her deliberate spending of $50k is just a 2.5% withdrawal charge from that 2 million. Since 4% within reason protected, 2.5% is a preposterously protected withdrawal charge.

However wait! There’s extra. Within the curiosity of being conservative, Alina has intentionally ignored a number of different key items of her personal monetary future:

- All future social safety earnings (over $2000 monthly for the final 2-3 a long time of your life)

- A extremely probably inheritance from her mother and father who, whereas sensible and vibrant and nonetheless doing nice, are of their early 80s.

- And he or she’s additionally assuming that she is going to by no means couple up with one other companion sometime and share family bills, even though she’s a beautiful and sociable individual with many choices on this division.

Her response to this sense of additional warning? Simply crank it out for an additional yr or three within the furnace of the working room, and maintain off on any luxuries to avoid wasting up one other few hundred thousand, simply in case.

Dave’s Deceptively Vibrant Future

My different good friend Dave is ten years youthful, with a decrease earnings however equally scrappy and really entrepreneurial. He has been a star performer in a really underpaid full-time job for over fifteen years. His complete annual spending – together with a mortgage on a $430,000 home right here in Longmont – is just about $45,000 per yr.

Though Dave lives in high-cost Colorado, he has fastidiously accrued eight rental flats again in his hometown (a midsized metropolis in Ohio), which very conservatively ship $2800 monthly of internet cashflow, whereas additionally rising his wealth by an extra $3000 each month by means of principal payoff and appreciation.

He additionally has a few aspect jobs, serving to numerous members of our native HQ Coworking area with their companies, which herald an extra $1000 monthly.

After which the kicker: Over the previous seven months, Dave and I teamed as much as renovate the primary ground of that considerably pricey new home into a really high-end Airbnb rental. We just lately pressed the button to make this place go dwell, and it turned an instantaneous success with just about no emptiness, now bringing in one other $5000 monthly (!?), whereas nonetheless leaving him together with his completed walkout lower-level house as a spot to dwell.

So, Dave resides in his personal basement accumulating $5000 each month, whereas spending solely $2000 on the mortgage. In different phrases, he’s residing without spending a dime and getting paid a further $3000 for the chore of proudly owning this home, a trick formally often called the “Mustachian Inversion”

In case you add all this up, he has a complete enterprise earnings of $8800 monthly ($105,600 per yr!), which completely dwarfs his $45,000 spending even with out taking into consideration the wage from that crappy full-time job which he has been desirous to stop for therefore lengthy.

Whenever you add within the extra $3000 monthly of mortgage principal payoff and appreciation of the leases, my good friend’s aspect hustles are netting him $140,000 yearly. And his financial institution accounts mirror this: there are sizable money reserves and upkeep and contingency funds for each rental unit, plus a well-funded private 401k plan and each different little bit of accountable monetary preparation you possibly can think about.

It’s possible you’ll be barely jealous of Dave as a result of he’s all set to chill and benefit from the proceeds of all this difficult work for all times. He may lower his earnings in half and his wealth would nonetheless improve quickly endlessly.

However bear in mind, on prime of all this he nonetheless has that full time job which is demanding about 10 hours of his time daily, with a number of hours of Zoom conferences packed in all through, eliminating the potential of slacking.

Dave is a good sport and places on a courageous face, however all of us within the native associates group can inform that he’s almost buckling beneath the stress of this shitty, irritating job, particularly mixed together with his overflowing salad bowl of aspect hustles.

“Dave, you cussed dumbass, it is advisable stop that job yesterday”,

is the loving message we’ve been attempting to get into his head.

“Yeah, I do know”, he says, “However I’m simply holding on for yet one more yr, simply to pad the accounts a bit additional. What if the Airbnb slows down? What if my rental homes expertise some emptiness? What if I wish to assist my nephew with faculty ten years down the road?”

Alina and Dave are each leaning upon the outdated rule of “You possibly can by no means be too protected”, and many individuals agree with that assertion, as a result of how may you argue with such plain folksy knowledge?

However this rule is wrong. It’s certainly attainable to be “too protected”, as a result of safety comes at a high cost – and the value is your personal life.

If Dave enjoys excellent well being and lives to age 90, he nonetheless solely has about 600 months left to dwell, or an much more treasured 240 months of “youth” earlier than hitting age 60. And Alina’s remaining 120 months of youth are much more expensive.

With each of their monetary conditions already so soft, why oh why are my expensive associates buying and selling away this time for jobs they don’t get pleasure from, simply to get that final shred of pointless security?

Why are they letting these jobs compromise their friendships and relationships, price them sleep, miss out on tenting journeys and worldwide adventures and simply plain lazy Tuesday brunches with the folks they love probably the most? (most of whom are already retired and at present having brunch with out them?)

The actual reply in fact just isn’t cash, it’s concern.

However if you happen to dig deeper, their concern continues to be about “operating out of cash”, although it’s virtually mathematically not possible at this level.

To coach away this concern in myself and others, I wish to conduct a thought experiment. And that’s to drive your self by means of the numbers (utilizing a spreadsheet) of those two issues.

- In case you stop your job proper now, what would a very good, typical, and improbably dangerous situation appear like on your monetary future?

- Then within the case of the “dangerous” situation, write down, step-by-step, what it might actually imply so that you can run out of cash.

This could be a loopy thought experiment, however in lots of instances it would additionally reveal simply how a lot of a ridiculously lucky fortress you’ve gotten constructed for your self.

As a result of not like you, most individuals within the US actually are virtually out of cash. They’ve just about no retirement financial savings, month-to-month spending that meets or exceeds their earnings, and an array of automotive loans, pupil loans, and bank card debt that grows yearly. A full ten p.c of households have a unfavourable internet value, and even the median net worth is beneath $100,000 that means half of us have solely a 1-2 yr cushion between ourselves and being lifeless broke.

If the common individual quits their job, any shreds of internet value can be depleted virtually instantly. At this level, the owner and the gathering businesses come calling, and they’d really find yourself with no meals or shelter past what is on the market by means of welfare applications. It’s a tough place to be, however this class consists of tens of millions of individuals within the US.

However for many Mustachians contemplating early retirement, the state of affairs is totally totally different. And to show this level, let’s attempt to get Alina to go bankrupt.

(observe: I made all the spreadsheets and graphs under in “actual” (inflation-adjusted) {dollars} in order that they make extra sense from our perspective of immediately. In actuality, all of the numbers (each spending and investments/earnings) will get larger over time relying on the speed of inflation, however the internet impact is identical)

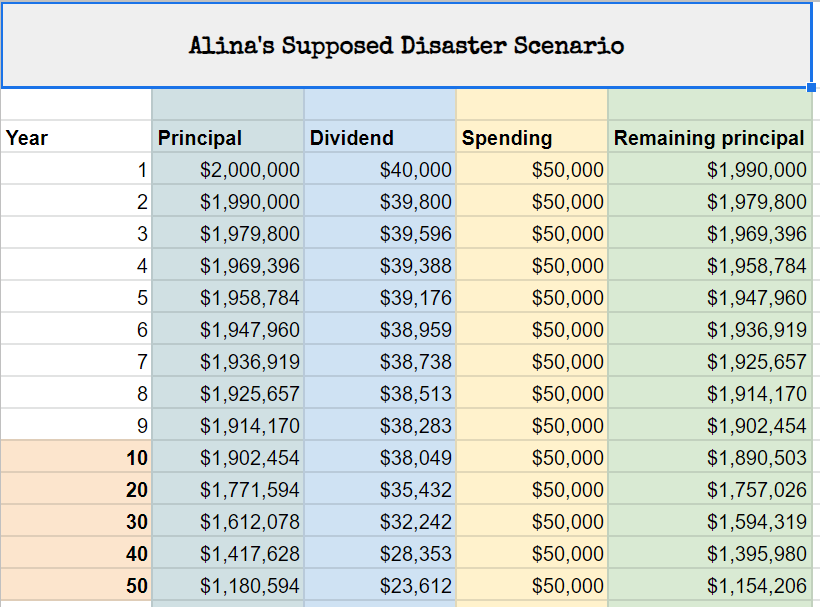

Alina: The Worst Case State of affairs

As a substitute of “yet one more yr”, she quits her job now.

Though the inventory market tends to develop together with the financial system, let’s assume we enter a by no means ending interval of stagnation the place shares barely even match inflation, and he or she decides to dwell solely off of the dividends of her $2 million portfolio, that are a paltry 2% in the mean time, or $40,000 per yr.

However regardless of her conservative funding administration, she insists on retaining her spending on the full $50k. She by no means rents out an house in her home, by no means finds any pastimes that generate any earnings, by no means switches from Entire Meals to Costco, retains up the worldwide journey, and at all times retains a new-ish automotive within the driveway even though she has no extra commute.

The US Social Safety program by some means will get canceled even though our ageing inhabitants carries the majority of the voting energy and would by no means vote away its personal retirement earnings, and her mother and pa determine to donate all their remaining wealth to charity slightly than leaving it to Alina and her sister.

Within the occasion of this ridiculously contrived instance, she would find yourself drawing down $10,000 per yr from her financial savings, which suggests her wealth would drain right down to, uh-oh, 1.99 million after the primary yr. And the development would proceed like this:

Uh-oh. So the worst issues have occurred in lots of areas of her financial life, and Alina lives out the subsequent 40 years of her life and dies with solely $1,395,000 within the account. What a harrowing shut name!

However what if issues turned out worse than the worst? Regardless of our greatest efforts to make her go bankrupt, she nonetheless died a millionaire. So we have to get a bit of extra Mad Max in our situation:

Alina: Fury Highway

The US decides to cripple its personal financial system endlessly so there is no such thing as a extra innovation, no productiveness, and all dividends are halted and but our 330 million residents all determine to go together with it.

Amid the chaos and the dune buggy machine gun battles which rage day and night time on the street, her wealth drains by $100,000 yearly and he or she is right down to a single million by age 60. However she retains up the spending and refuses to make any modifications. She’s broke by age 70 however simply sticks to her favourite actions that are rewarding and interesting however by no means produce a penny of earnings.

Her mortgage checks begin to bounce. The financial institution finally enters foreclosures however she stays glued to that home. After one other yr, the foreclosures is full and the sheriff arrives to pull her wiry 71-year-old body out of the home, kicking all the way in which.

Alina is eligible for social applications, however rejects all of them. She has an enormous community of associates, however doesn’t settle for any of their presents for assist or employment.

She checks into a pleasant all-suites resort and begins paying all her payments with bank cards, maxing all of them out together with some money advances to maintain the cash flowing. With the standard tips of stability transfers and delayed-repayment plans, she retains the occasion going for 2 extra years, till all of the bank cards have been canceled and despatched off to collections.

At age 73, Alina is lastly out of cash. She can not purchase meals or shelter and he or she has lastly arrived at a actuality that homeless folks at present expertise daily proper now. However we needed to make up a completely ridiculous and albeit not possible story to get her there.

I’ll spare you the lengthy story of Dave’s decline, however it’s equally not possible.

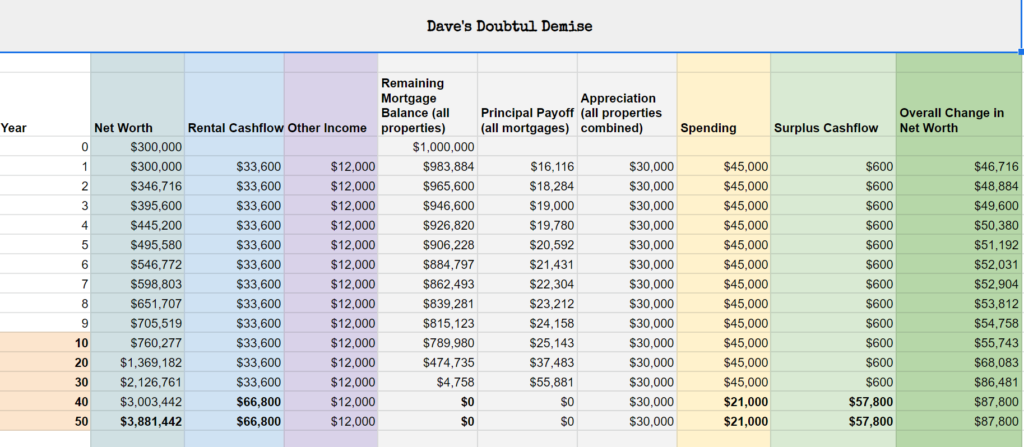

Dave’s Uncertain Demise

If he stop his job immediately, stopped airbnbing his home and simply loved the entire thing and by no means even rented out the decrease stage, forfeited his six-figure 401k account and social safety and the whole lot else besides the rental properties and the $1000 from native gigs, this might occur:

What the heck!?

We threw Dave into the worst of conditions, one thing far past simply quitting his crappy day job and arguably not possible. But not solely does his cashflow proceed to extend, however his internet value skyrockets by about $50,000 per yr, ending up at virtually $4 million {dollars} (inflation-adjusted too) by the point he kicks the bucket at 90 years outdated.

In actuality, that purple “different earnings” column is prone to be triple what the spreadsheet says, his 401(ok) account will certainly live on and develop, and lots of different good issues will occur.

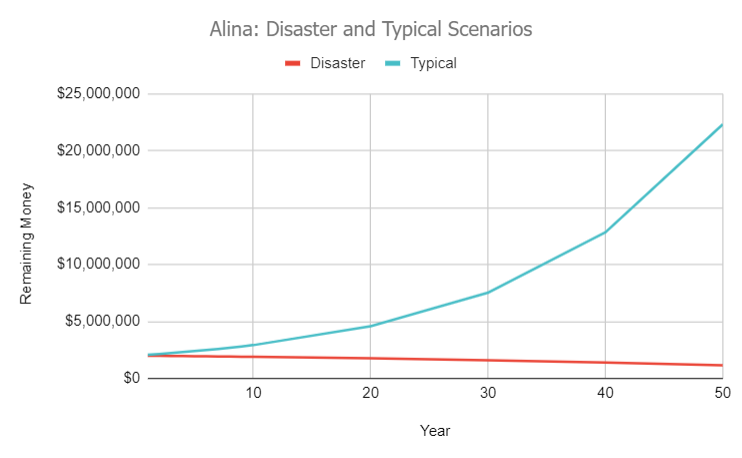

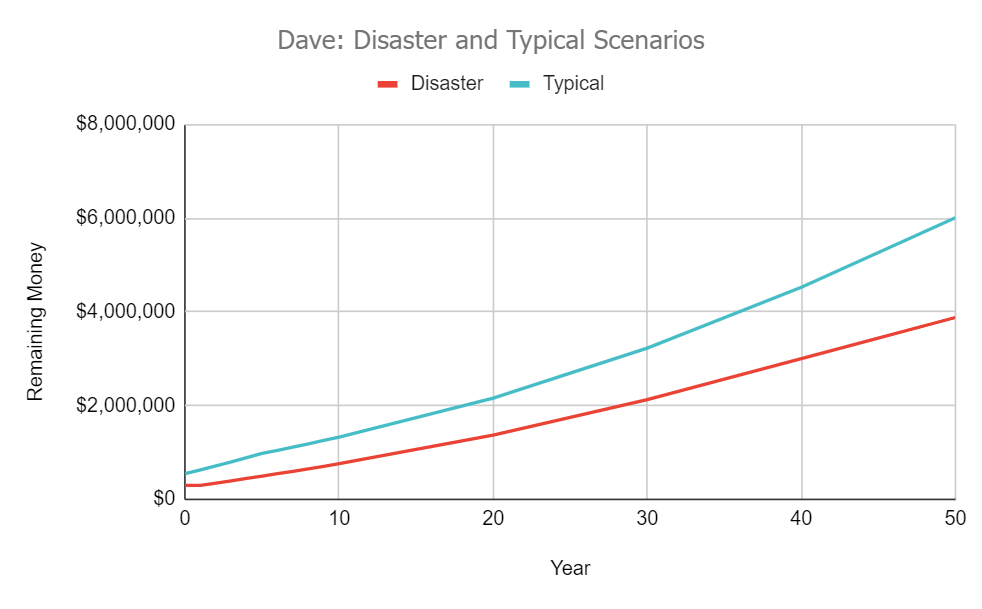

Extra Life like Projections for Each Of My Mates

In case you’re a pessimist, you will have checked out all of these numbers above and mentioned, “Hmm yeah they made it, however it was a bit of shut”. However bear in mind, these have been worst case situations. It’s silly to plan the whole lot in your life across the worst case situation, as a result of it would usually lead to you having the minimal attainable quantity of enjoyable.

So as an alternative, it is advisable not less than embrace a conservative estimate of what’s more than likely to occur. And I’ve completed so for each Alina an Dave, creating these graphs of the outcomes

So, each of those associates cannot solely stop working, they’ll additionally begin forking out more cash on no matter they need. Congratulations to each of you!

Each of them, and extra importantly a big share of MMM readers, probably together with YOU, are past the purpose the place they may ever run out of cash even when they stop their jobs immediately.

And they should see this glorious reality for what it’s, in order that they’ll confidently act on it, in order that they’ll cease giving freely treasured months of their lives away to their employers, to amass nonetheless extra chunks of simple cash, so as to add to a pile that they are going to by no means, ever, ever want.

After which they’ll begin experiencing precise actuality of early retirement, which is as follows:

- Your spending finally ends up a bit of bit decrease than you anticipated, regardless of your finest efforts to splurge on your self and be beneficiant to others.

- Your investments do maintain going up over the long term, exceeding these conservative forecasts you made.

- You do find yourself making bits of cash right here and there (in Dave’s case shit-tons of cash), although you completely don’t want it.

- Because the a long time go and you compromise into this sample, you notice that cash just isn’t one in all your worries. Life as a Human Being nonetheless presents loads of challenges, however holy shit, thank goodness you stop working once you did as a result of it was utterly pointless. Wanting again, you most likely ought to have completed it a number of years earlier.

If any of this sounds acquainted, congratulations – you’ll by no means run out of cash which suggests it is advisable cease letting it rule your life.

Stop your job.

Critically.

Sheesh. What are you ready for?!

Epilogue: Mr Cash Mustache Chills out for a Splurge too:

Writing this text jogged my memory that I can also nonetheless be a sufferer of excessively frugal habits. Positive, my home is gorgeous and I’ve nice meals, vehicles, instruments, bikes and the whole lot else. However in terms of journey, I begin taking part in foolish video games with myself.

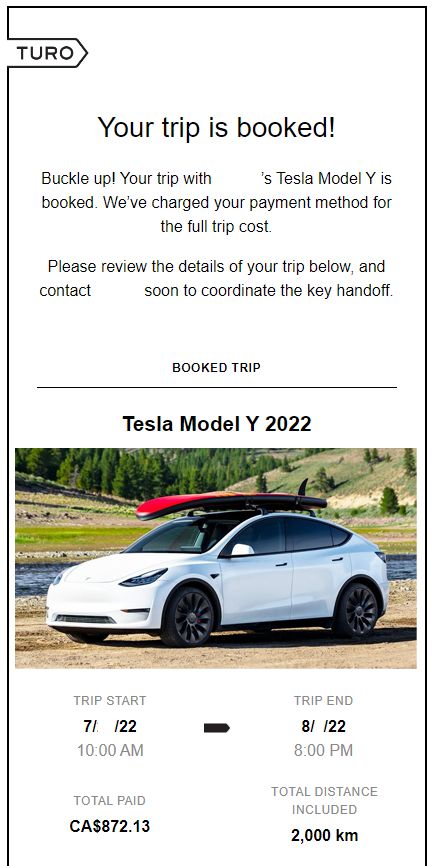

For instance, my boy and I are heading to Canada later this month to go to the household. And in opposition to all logic, I seen the Nagging Voices of Cheapness beginning to chatter in my head.

“These airplane tickets have been solely $210 every – can I actually justify paying an additional $80 for an even bigger seat on the entrance of the airplane? And sheesh, how can I get across the $150 roundtrip Uber trip (or $150 roundtrip driving+parking) to the airport, that’s ALMOST AS MUCH AS THE PLANE TICKET! Ought to we spend an additional 3 hours roundtrip to avoid wasting $100 by taking the bus?” After which what about our transportation as soon as we’re in Canada? Bus? Automotive rental? Practice tickets? How does the $7.00 per gallon gasoline issue into this provided that we have to journey over 800 miles throughout our time there?

Blah blah blah. The proper reply is “Shut up, Mustache! You need to do no matter you assume is most enjoyable and least irritating, with out eager about the cash.”

For me, this implies driving my good electrical automotive on the speedy toll highway to the costly Denver Airport parking zone so we are able to stroll proper into the terminal with no shuttle. It additionally means sitting in a very good airplane seat, after which taking the least irritating and most enjoyable type of transportation as soon as I get there.

Why? As a result of the distinction between the most affordable and most irritating journey, and the most costly one on this case, is just about one thousand {dollars}.

Even when I did this each single yr for the remainder of my life, I’d blow $50,000 on luxurious journeys to go to my household (and I may drive my Mother to her a hundred and twenty fifth birthday in fashion!)

And primarily based by myself worst-case spreadsheet, I’m by no means going to get up and assume,

“Rattling, if I simply had one thousand extra {dollars}, and even fifty thousand {dollars} extra on this internet value column, I’d be a happier individual”

So I get to loosen up, and luxuriate in my journey, and guess what I even did this:

So I’ll see you in retirement, and possibly even in Canada later this month!

Additional Homework for Spreadsheet Lovers:

I’ve shared a replica of the Google Sheets spreadsheet I made for these examples and graphs here. You need to be capable to “file->make a replica” to get an editable model to fiddle with. Mine are fairly primary and pass over some particulars to be able to keep away from getting any extra sophisticated than they already are, however be at liberty so as to add extra if you happen to like,

Within the Feedback:

Are you too fearful, or too optimistic, or someplace in between? When you have already stop your job, how did you get the arrogance? In case you’re nonetheless caught in One Extra Yr Limbo, what wouldn’t it take to get you out of it?

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/paintbrush-800.jpg)