Learning2Fly wrote: On September 5, 2024 at 7:47 pm., Learning2Fly published:

My mid to late 30’s self has come to realize I have not taken investing and retirement seriously enough, investing funds through Edward Jones with my family’s same financial advisor, yet now feel like moving on – worried that old age savings are going nowhere fast, I need a plan in place so that I actually start investing for later life.

About Us

My wife is 36. Together we have two children (2 & 6).

My pay can fluctuate because I co-own two small businesses alongside my wife who mostly cares for our kids. Roughly speaking, we make approximately $157,000 combined annually depending on business performance (this may go up or down depending on specific situations in each business but I believe this figure to be representative). Unfortunately neither business offers 401k plans yet and getting my co-owners on board to establish one would likely not be an option so instead let’s assume this as being my limit of potential earnings potential.

Our only debt is our 3.65% mortgage and car payment (currently at 3%).

Current Cash Balance of $33,000 in Standard Checking Account

Current investments – All held through Edward Jones; our aim is to exit EJ.

My Wife’s Roth IRA stands at $34,000 whilst My Roth IRA stands at $30,000. Additionally, she also had her 401K at her old job (through Empower) which now totals up to an impressive total of $38K

Taxable brokerage account 1 for both of us: $5,000

Taxable brokerage account #1 (both of us): $29,000.

As stated previously, our goal is to transfer our savings out of EJ and into Fidelity. I suggest the following plan.

At present, our emergency funds total approximately five months of expenses if something unexpected comes up.

My Roth IRA accounts (worth $30K and 34K respectively) should now be invested with Fidelity 2055 target date fund.

Leave the current $38,000 of 401k investments (at Empower) where they are, but if that option becomes possible through Empower, transfer to one or more Vanguard target date funds if possible – as I don’t believe doing that would create any tax implications.

Move our existing Edward Jones (which totaled $34,000 total amounts) as well as $77,500 cash accounts into a 90%/10% VT+BND portfolio (I am not worried about tax efficiencies with VTI+VXUS+BND); I understand this will create some form of a tax issue which needs to be managed, however; better to remove it head on than put off doing anything about it now?

Moving forward, our strategy should include fully funding Roth IRAs – already done so – while setting aside $500 every month into this taxable brokerage VT/BND mix VT and BND mix.

Do you have any input or insight regarding my plan? I would welcome any thoughts and/or advice about it!

Simplicity is extremely important to me and I don’t wish for perfection to overtake good enough decisions. Otherwise I become paralyzed with indecision.

Thank you and congratulations on taking steps away from Edward Jones to opt for lower cost DIY plans! It may be worthwhile considering other locations or alternatives than your taxable account for BND holdings if this becomes necessary; Treasury Direct/I Bonds could potentially delay taxes as an option or tax-exempt municipal bond funds could help hold some bonds while leaving more equity exposure than before at 36. Until other answers arrive from others here however there should be options in your business to tax defer some income directly into retirement accounts – hopefully someone here has insight on this matter

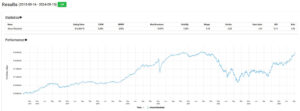

Regarding investment expenses, your goal should be to save as much pie as possible. EJ devoured too much by being in the top row of pies in this graphic; your investment costs should strive for placement on lower rows of pies instead.

Looking at some guides regarding savings requirements at certain ages to fund retirement, your current $263,500 is close or on target with what Fidelity, JP Morgan and T Rowe Price suggest for age 40 as your goal.

Here are a few guides…

Fidelity wants to see you with 3X of $157K at age 40.

JP Morgan wants you to reach $385K+ by the age of 40.

T. Rowe Price suggests you aim for at least 2X $157K by age 40.

Cyclingduo Cycling duo

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/Re-Please-give-me-feedback-on-my-plan-to-become.jpg)