Whereas on the Imgur web site, right-click the picture to get the deal with to the PNG or JPEG file. Then on this discussion board use the picture tags together with your file deal with in between them like this.

[ img ] https://rawnews.com/wp-content/uploads/2024/09/Looking-for-help-creating-a-ten-year-investment-plan.jpeg [ /img ]

While you take away the areas… the picture ought to present up in a preview like beneath.

schmitz wrote: ↑Tue Aug 27, 2024 1:26 pm

My plan can be as follows:

- (1) promote all the 2020 TDF in taxable in addition to somewhat of the 2040 TDF in taxable (as much as my 2020 capital good points losses) and purchase VTI/VXUS with that cash

- (2) step by step promote the remainder of the 2040 TDF in taxable (not 100% certain how a lot I can promote annually, however I’ll analysis this additional) and proceed shopping for VTI/VXUS inside taxable

- (3) promote all TDFs inside SEP and two ROTH accounts and purchase VOO as an alternative

- (4) promote all lifecycle funds inside TSP and transfer cash to C and G funds

- (5) flip off reinvesting dividends

Hopefully that is getting me heading in the right direction?

That every one appears high-quality. #2 is probably going how a lot you need to pay in capital good points tax that yr (usually simply to the highest of your present tax-bracket or to the highest of some greenback threshold you do not need to pay greater than in that yr). For #5, you are solely turning off auto-reinvest within the 2040 fund within the Taxable account. It is high-quality to go away that on for VTI/VXUS within the Taxable account in addition to in all of the tax-advantaged accounts.

Simply the Taxable accounts… SpecID helps Tax Loss Harvesting (TLH), which solely applies in a Taxable account. Your plan ensures that you do not maintain the identical funds in Taxable as tax-advantaged, so your away from wash sale guidelines if you do execute TLH in Taxable.

Per #5 within the your “to do” checklist, you may solely be turning off dividends on the 2040 TDF in Taxable. You possibly can depart it off for VTI and VXUS if you happen to plan to do handbook TLH, however that could possibly be a every year exercise in Nov or Dec, so if you happen to’ll be doing this sometimes, I would counsel leaving auto-reinvest on for VTI and VXUS in Taxable (avoids a cash-drag in your account if you happen to overlook to reinvest manually).

schmitz wrote: ↑Tue Aug 27, 2024 1:26 pm

(3) Simply needed to confirm that purchasing/promoting funds contained in the SEP, ROTH and TSP accounts have zero tax implications, proper? Would hate to get an enormous surprising invoice subsequent yr. Its solely within the taxable that I should be cautious what and the way a lot I purchase and promote?

Sure, you’ll be able to freely swap your whole positions inside tax-advantaged accounts with zero tax implications (SEP, Roth, and TSP). If you happen to swap issues in a Taxable account there could possibly be a tax invoice (constructive good points) or a tax offset (unfavourable losses).

It is a private alternative, however the typical solutions are between 40% (world market-cap that TDFs typically use) and 20% (Bogleheads with a house bias), or 0% (these with a fairly large house bias); that is a proportion of shares solely (does not change your bond allocation). There is not any proper or fallacious reply; it is what you are comfy with given the information that investing is a worldwide stage, not only a US stage. Here is some background to assist make your resolution.

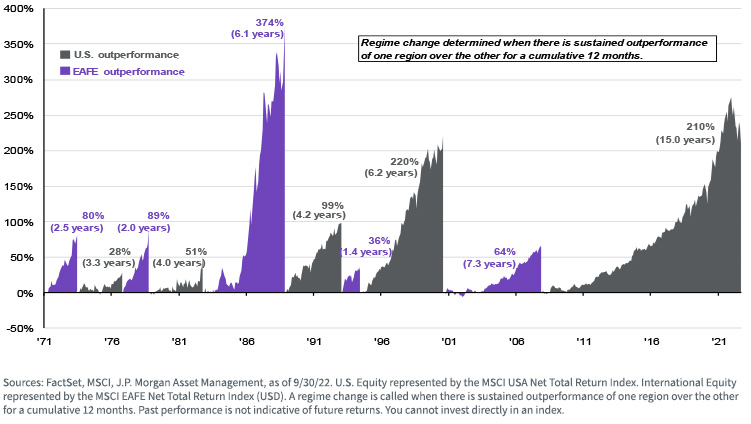

There’s basically two camps amongst Bogleheads: a) These which can be on board with the worldwide market cap weighting, which is about 60% US inventory and 40% ex-US inventory; and b) people who have a house bias (US will often outperform), which is about 80% US inventory and 20% ex-US inventory (some even omit Int’l altogether). I am in camp a) based mostly on the chart beneath from WisdomTree, the white paper from Vanguard, and the newer article from Vanguard.

Vanguard White Paper: International Equity – Considerations and Recommendations

Vanguard Web Article: Making the case for international equity allocations

Do not do what Bogleheads let you know. Hearken to what we are saying, think about different sources, and make your personal selections, since you must dwell with the dangers & rewards (not us or anybody else).

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/Looking-for-help-creating-a-ten-year-investment-plan-1024x640.jpeg)