That is nice! So many do not even have any cushion. The everyday suggestion is 6-18 months of bills, however your particular time-target relies on how lengthy it could take to discover a substitute job at related wage. So if discovering a brand new job is <12 months you are golden. In case your business has imploded, you are going through a possible layoff, and it could take >12 months, you then may wish to cease investing for retirement and add extra cushion to your EF.

You may’t beat 0% curiosity debt, however debt nonetheless needs to be repaid, which limits your cash-flow for investing in the direction of your future. Particularly will the A/C debt be paid off earlier than the rate of interest jumps as much as a non-zero quantity? How excessive will the A/C rate of interest leap if there’s nonetheless a steadiness after one 12 months? Additionally, what does A/C stand for?

Your AA and int’l publicity appear effective to me, however when you’re not sure, then take into account one or each of the workouts beneath.

Management Your Danger

1) Learn the Wiki article for Assessing Risk Tolerance, take the Vanguard Investor Questionnaire, then tailor the asset allocation (AA) that was really useful by the quiz based mostly in your data of your private threat tolerance having learn the Wiki article.

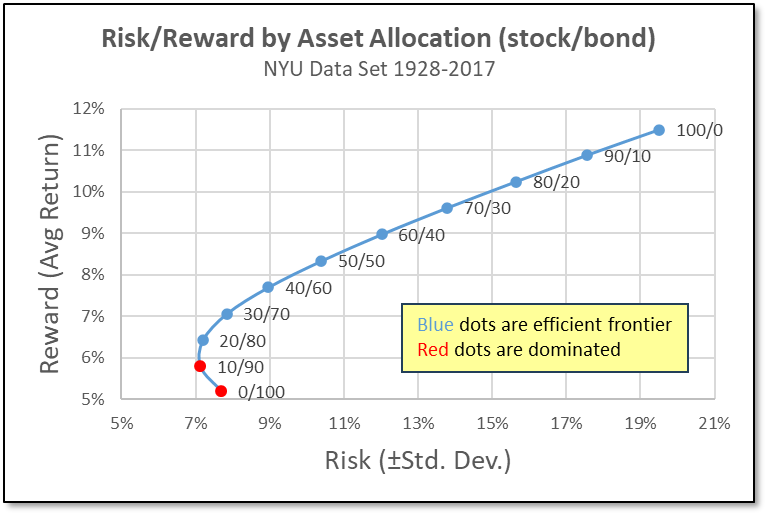

2) Alternatively (or along with), ask “How a lot of a drop in portfolio worth as a % of complete worth can I deal with?” minimize that % in half to get commonplace deviation, then lookup that std. dev. on the X-Axis of the chart beneath, and at last scan as much as see what AA that corresponds to. For instance, when you can solely abdomen a -24% drop in portfolio worth, that is a ±12% std. dev, which corresponds to an AA of 60/40. The return you get is a median and you will get what you get together with your distinctive sequence of returns (there’s quite a lot of variance in outcomes as a result of related volatility of shares so it most likely will NOT be the typical, however one thing kind of).

———-

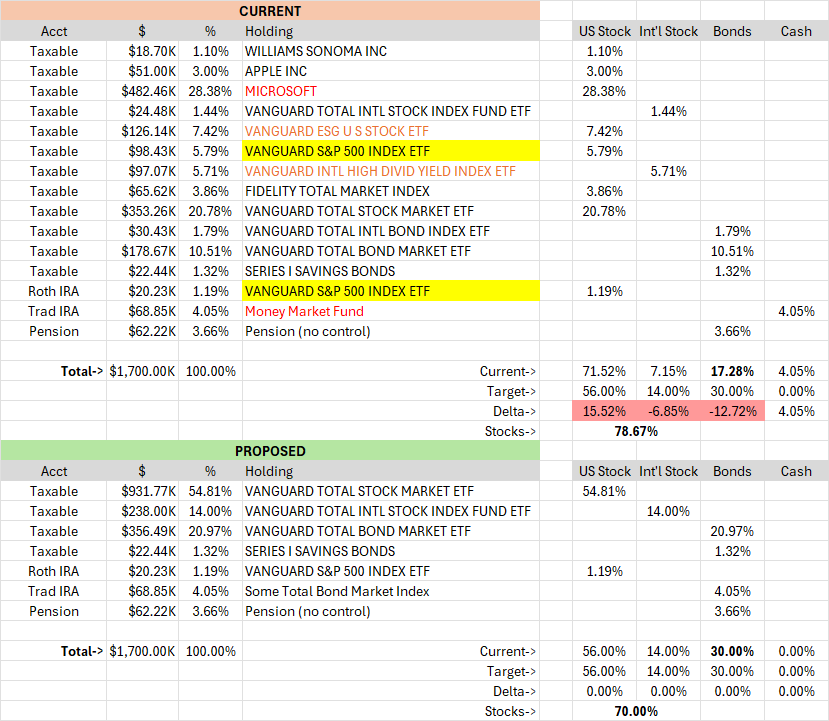

That is what I see in your “present” portfolio and the way a easy 3-fund portfolio may look within the “proposed” part. I am not suggesting a direct leap to that proposed portfolio, it is simply there to say how easy it could possibly be at some future level, however a leap in your Taxable account could have instant tax penalties that you could be not be capable to afford given a possible job loss/substitute search could possibly be imminent. You may simplify the tax-advantaged accounts with no penalties.

You are present portfolio is nearer to 80/20 than 70/30 so the danger is larger than your required goal. The proposed portfolio meets your 70/30 goal with a fund placement that avoids Wash Sales (you are presently holding S&P-500 in each Taxable and the Roth IRA which exposes you to the potential for wash gross sales). Since you do not have a Trad 401k, there’s not sufficient room in your Trad IRA to carry your 30% bonds, so that they’re largely within the Taxable account, which does not adhere to Tax-Efficient Fund Placement, however typically that is not all the time potential. Given that you just’re doubtless in a 22% Fed Tax bracket (based mostly on an efficient tax price of 17%), I’ll guess {that a} CA Municipal Bond Fund isn’t a greater deal for you than nominal bonds like Complete Bond Market, however I did not run the numbers on Tax-Equal Yield (TEY). I can have a look at that, if it is of curiosity/concern to you.

I’ve counted your contribution steadiness to your pension as a bond allocation (because it’s included in your holdings including to 100%). in case you have final religion that this pension will truly be paid to you in full and can by no means be decreased or outright default (it is insured and managed by a third social gathering with no firm entry to raid it after contributions are vested), then there’s an accounting strategy to worth the long run pension funds as the web current worth in your bond allocation (which would scale back the quantity of tax inefficient bonds you could maintain in your Taxable account as a result of the pension steadiness would get replaced by a “phantom” bond that’s equal to NPV on the pension funds). I want to easily use pension funds to scale back my retirement bills and handle my portfolio independently of any pension, since I’ve no management over the allocation of the pension nor do I’ve final religion that it wont’ be decreased (my mother’s RI state instructor pension was decreased after she began receiving advantages when the state had a fiscal disaster). The one pensions I might rely as a phantom bond based mostly on NPV could be a Federal pension. In case you do have final religion and wish to take into account the NPV of the bond, then here is an article from the Journal of Accountancy on Valuing an Annuity.

I might recommend that you just ultimately unwind all of the Taxable positions apart from Vanguard Complete US Inventory Index, Vanguard Complete Int’l Inventory Index, and Vanguard Complete Bond Index (in addition to the I-Bonds doubtless held at TreasuryDirect). Nonetheless, the positions in Microsoft, Vanguard ESG US Inventory, and Vanguard Int’l Excessive Dividend Yield Index are all greater than a 5% stake of your complete portfolio, so some thought of unwinding these over time is probably going warranted. At a minimal, flip off computerized reinvestment of distributions for all of the holdings you plan to ultimately do away with so they do not get any greater from that supply (limits progress to capital appreciation); manually reinvest the dividends from these undesirable holdings again into the three Vanguard ETFs you may be protecting. You are additionally sitting on 4% money within the Trad IRA, that I’ve prompt needs to be re-deployed into some type of Complete Bond Market that’s NOT “considerably equivalent” to Vanguard Complete Bond Market Index that you just’re holding in Taxable, in order that you do not run into wash sale points; an intermediate-term treasury fund if out there within the Trad IRA could be effective (if it is transferring to Vanguard that will be VGIT-ETF or VFITX-fund).

This is a hyperlink to a template spreadsheet (not your knowledge) to do this sort of present/proposed planning your self.

Asset Allocation Sheet

AA Current and Proposed

You are over 50, so you possibly can contribute $8,000 (when you can afford the additional $500).

Do not do what Bogleheads let you know. Take heed to what we are saying, take into account different sources, and make your individual choices, since it’s a must to reside with the dangers & rewards (not us or anybody else).